The only constant thing in the BFSI sector is ‘change’. This article addresses the training challenges and e-Learning strategies for the BFSI sector.

The BFSI (Banking – Financial Services – Insurance) industry has been going through a rapid transformation due to progressive economic reforms, changing demographics, and fast-paced technological developments. Banks, in particular, have been facing teeming challenges such as regulatory risks, up-gradation of technology, intense competition, operational risk, and workforce challenges. Keeping the workforce suitably trained and equipped with up-to-date knowledge and information regarding each of these challenges is essential.

Per the World Bank, India has one of the world’s fastest growth of branches of commercial banks across the world. Naturally, the Indian banking system is also experiencing an increase in employee intake over the last few decades. It is one of the largest recruiters and is expected to generate more than 20 lakh jobs in the near future.

New banks are being set up in every other city, and there will be a growing demand for sales executives, business correspondence, and other banking professionals to reach out to the rural population. While there are enough growth opportunities, the sector is expected to face major workforce challenges. A bank’s success depends on the satisfaction of employees, who are the major stakeholders of the business. Hence, banks must focus on recruitment, training, development, and retention.

The BFSI sector needs to address acute skill shortages effectively in the system. Adopting new technologies is a prerequisite to making the work environment more time-managed. Due to the fast-growing economy with dynamic technological development and skill innovations, employees are less likely to adjust to the work culture. The operational loss of banks due to human errors is 7% in the Indian banking scenario.

Employees should be well trained to minimize such losses and understand human errors’ effect on profitability. Banks may address these issues through a well-structured training need analysis and setting of targets for the number of worker-days of training.

Table of Contents

Increasing demand for sales roles in the BFSI sector:

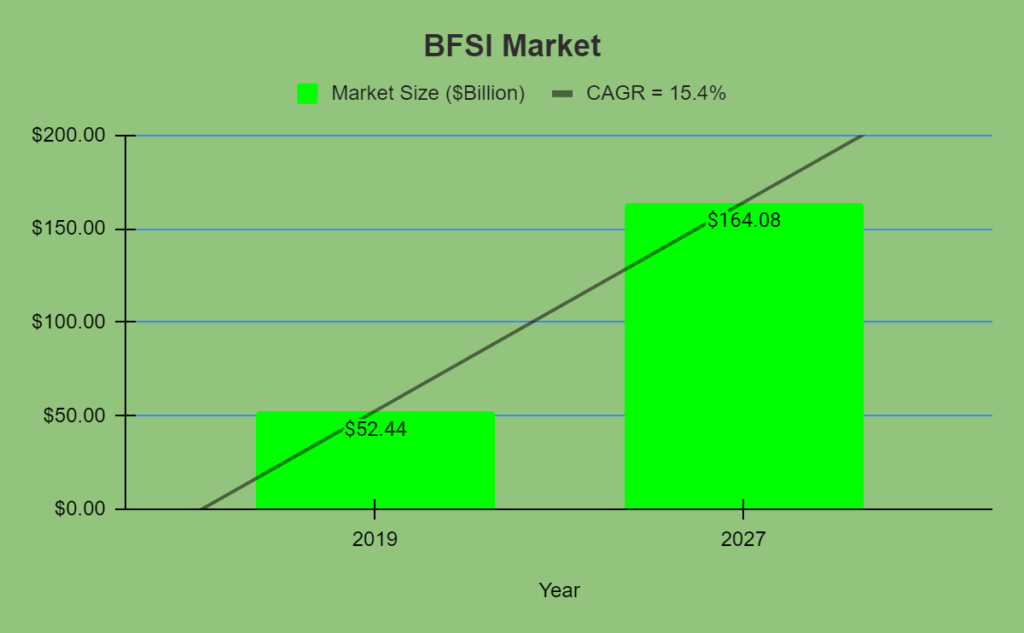

“The global digital transformation in BFSI market size was valued at $52.44 billion in 2019 and is projected to reach $164.08 billion by 2027, growing at a CAGR of 15.4% from 2020 to 2027. It is expected to create additional employment of over 1.6 million during 2013-2022 — the National Skill Development Corporation (NSDC) said in its report.

As banks and insurance companies promote m-learning (mobile learning) and Artificial intelligence (AI) driven products and services, one cannot overlook the growing demand for sales and marketing roles. In fact, a 22% growth is expected in sales and distribution roles. The industry’s increasing talent demand is faintly met by a limited supply of professionals willing to take up sales.

It is not always about the target achievement pressure, which makes the sales professional wary; it is also about the gap between their actual work experience and what they are expected to achieve on the job.

“Industry needs to provide additional training to its employees to enable them to scale up to the changing trends,” as per NSDC MD & CEO Dilip Chenoy.

Here are some of the associated job roles in BFSI

Insurance agents

They work with clients and suggest the best insurance policies based on their clients’ needs. They may also help settle claims. An insurance agent can either be captive, employed by a single insurance company, or independent, working for and selling the policies of several companies. Many insurance agents also offer financial planning services to clients interested in planning their retirement and setting up investment or pension plans.

Investment representatives

Investment representatives, also known as financial planners or advisors, work at banks, credit unions, or investment firms and provide advice regarding investment products and financial services. They market their products and services through telephone sales, in-person visits, and sales leads. They are responsible for conducting the administration of investment products and services.

Investment banking associate

In a client-facing role in the financial industry, an investment associate works with clients to identify their financial needs and develop ways to meet their short and long-term goals. They are the first point of contact for clients.

Equity product sales executive

Equity sales executives or equity dealers are responsible for researching the latest equity trends, generating total returns on allotted assets, and fund management.

Bank and Financial product sales executive

Bank and financial sales executives are responsible for handling and looking after the sales of all bank products, including loans, credit cards, mortgages, etc., and financial services.

Key attributes of the best-rated BFSI employees:

In-depth knowledge of the sector and being up to date with the latest developments are necessary to remain competitive.

Analyzing skills

An employee with an analytical brain, numerical ability, and learning agility scores way higher than one who knows it all but cannot evaluate.

Comfortable with technology

There is no sector that the advance in technology has left untouched. Hence, a knack for learning and understanding new technology can be an added advantage.

Excellent communicator

Communication skills – verbal or written – help to get along with colleagues and clients. For a sales employee, it is essential to communicate well, as the chances of persuading others to listen are rising exponentially.

People person

The BFSI sector needs excellent people skills. To be able to relate to others, have patience, listen and show empathy.

Authentic and display integrity

Whether it is a bank, insurance firm, or mutual fund, the BFSI sector is all about money. Nevertheless, personal integrity is an invaluable quality.

The BFSI sector is not a monolithic establishment where all employees perform the same role. Each division requires a specific core skill set.

Training challenges faced by the BFSI sector:

Most industries face challenges regarding corporate workforce training, many of which are unique to that particular industry, and the Banking, Financial Services, and Insurance (BFSI) sector is no exception. These sectors have several unique characteristics to other sectors in the way they are organized and managed, which means that these sectors face different challenges that need special attention to be overcome.

PlayAblo’s Corporate Learning solution is robust yet very light weight and fun to use ensuring high degree of engagement and course completion. Find out more and request a custom demo!

Sales staff in multiple locations

Most firms in the BFSI sector have global teams and matrix structures these days. This creates new challenges whereby trainers are often asked to give courses to a classroom of participants. In contrast, simultaneously welcoming participants from other cities by video conference can be quite tricky as face-to-face training skills differ from those required when engaging a group by video. With their globally and geographically diverse employees, training access can be complicated.

Regulatory and compliance constraints

It is not uncommon in the banking and financial sectors to face rapidly evolving regulatory frameworks and audits throughout the year, requiring equally rapid and effective training. It is essential to be able to update content quickly and easily without having to redesign the entire course.

The tech-savvy generation

A shift is the evolution of the workforce, of which millennials account for a significant portion. Today’s tech-savvy employees look for completely digital, on-demand solutions. They are not only different from preceding generations in terms of mindset, needs, and technical aptitude but also tend to be volatile regarding jobs.

Ensuring all staff meet training standards

All staff must complete their training in full and to a satisfactory standard. When training is delivered on a large scale, nationally or globally, it can seem challenging to have a complete overview.

Limited time

Training an employee whose job is in an Investment Firm’s dealing room or a bank’s trading floor can be highly challenging because every minute away from the desk is time that’s lost in revenue generation. Similarly, the sales employees are always on the go and have very little time for classroom training.

Resistance to change

Most organizations in the banking sector have a long history and staff that have worked in the industry for many years. With this can come resistance to change as new training plans and programs are rolled out. An affinity to long-standing processes and traditions can cause issues.

Supplementing existing courses

If a large piece of existing training requires a supplement or an unexpected update, it does not need to cause a delay to the planned start of an instructional session.

Overwhelming levels of information

In the BFSI sector, there are extensive levels of information and training that each employee must get up to speed with. It can be an overwhelming process.

Strategies for Training in the BFSI sector:

Collaboration with academic institutes

It helps banks obtain the exact skill pull based on the job profile. Since the courses designed by academic institutions are in collaboration with bank employees, the training duration of newly joined employees will be reduced, saving banks costs.

Training has to be fast, and the results even faster

It should be offered in different time slots to cater to the needs of different people. Hence, digital learning allows a faster onboarding process, a significant reduction in operating costs, and easier customer acquisition.

AI and L&D

While artificial intelligence (AI) and automation can better serve the complex needs of consumers today, companies also need to consider how they can help them advance their training programs to make learning and development (L&D) effective and personalized.

Doing so can be a massive boon for onboarding, upskilling, and reskilling efforts and help ensure effective compliance training across the board. It also makes learning more fun by enabling various scenarios.

Through an AI-powered learning experience platform, L&D teams can create personalized learning that focuses on crucial competencies to prepare employees for the future. They can access selected content based on their learning preferences and skill gaps, enabling them to build their learning paths.

eLearning

E-Learning based training has proven to be a solution to the problems arising from instructor-based training across vast expanses of a financial organization.

It allows you to make edits and apply them across all courses quickly. It also enables the sales team to download courses on their own devices and access them anytime and anywhere. New features and innovations can be updated quickly, and training can be given on the new ways of dealing with customers and so on.

Multi-device access

With multi-device access and an authoring tool that offers built-in analytics capability, it becomes easy to ensure everyone is on the same page.

Informative, interactive, and infographic-based content evokes learners’ interest and ensures higher concept retention.

Such platforms can also empower sales teams with on-demand information while having the new joiners add value from day

It offers the means to improve engagement levels while ensuring regulatory compliance through microlearning and solving many of the issues faced by BFSI companies.

Staff engagement

How can you retain staff engagement during e-learning and ensure that it is effective? You can break down the subject matter into smaller courses and utilize features such as quizzes, animation, and moving image content, which makes the training seem less overwhelming and easier to absorb. Small sections of courses can quickly be updated and rolled out with minimal impact on team resources.

Using video tutorials as a part of the innovative training. They enhance the learning experience and are easily accessible.

Soft skills training

A well-designed soft skills program can train your employees in customer services, sales, HR, and team building.

Statistical and analytical assessment reports enable a robust monitoring system for determining the strengths and weaknesses of learners.

The sales managers can easily track the performance of employees within their team or to whom they assign a specific online course. The LMS analyses progress metrics based on individual KPI scores and then automatically generates a performance assessment report to measure learners’ skills on particular topics.

The LMS also triggers automated notifications/reminders across personalized mobile devices of employees to indicate their performance status on completing a specific module.

Conclusion:

Technology has changed the way banking is done. It is not only about the solutions; your organization offers to its customers but also about providing cutting-edge technology for employee and business success. By moving to a modern workplace learning experience that delivers personalized learning and training, BFSI companies can respond dynamically to changing market conditions and new business demands.

Workforces are significant assets for any business. The workforce problem is more pronounced in the BFSI sector because they mostly rely on employees’ skills and persistence. Over the past few years, there has been a standard shift in workforce training, upskilling, and performance assessment of the BFSI sector.

By utilizing modern learning management systems, companies ensure improving overall levels of employee engagement, performance, and knowledge retention. The BFSI domain’s potential in e-learning is ever-increasing, and there are umpteen opportunities to explore. E-learning can significantly affect how learning is delivered and consumed in the BFSI sector.

Research Articles:

- Researchgate – Workforce Challenges in Indian Banking Scenario – Journey from Identification Till Mitigation

- TrainingIndustry – Training Challenges for the Financial Services Industry

- Workforce challenges in Indian banking scenario – Journey from identification till mitigation

- YourTrainingEdge – Addressing Training Challenges of the BFSI Sector through Robust Learning and Performance Management Systems

- The sales role: understanding the drastic changes

- NSDC Report – Human Resource and Skill Requirement in the BFSI Sector

- A BFSI career: Prospects and essential skills

- 7 Core Skills You Should Have for a Job in the BFSI Sector

Comments are closed, but trackbacks and pingbacks are open.