In this article, you will uncover the crucial technical skills for advancing in the FinTech sector, from data analysis to AI. You will also understand how continuous learning can fuel both personal career growth and the industry’s innovation.

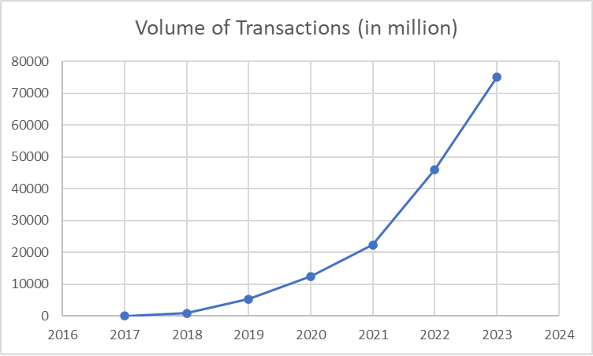

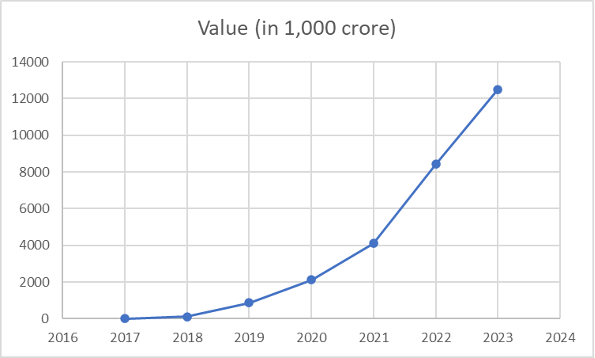

In May 2023 alone, India’s Unified Payment Interface (UPI) processed an astounding 9.41 billion transactions, valued at approximately INR 14.89 lakh crore. It equates to around 3,600 transactions per second, marking a 58% year-on-year increase in the volume of transactions.

This isn’t just a number; it’s a testament to the seismic shift happening right under our noses in the financial technology landscape. And guess what? You’re right at the heart of it.

Let’s talk about the powerhouse driving this change – your team. The digital era demands more than just traditional skills; it calls for a mastery of advanced technical competencies. Why, you ask? The FinTech domain isn’t just evolving; it’s redefining the very essence of financial services, making it crucial for your employees to be equipped with the latest tech skills.

But here’s the exciting part: by empowering your team with these cutting-edge skills, you’re not just keeping up; you’re setting the pace. You’re building a workforce ready to innovate, adapt, and lead in a market where technology and finance converge.

So, let’s embark on this journey together, shall we? By fostering a culture of continuous learning and innovation, you’re not just contributing to your organization’s growth but shaping the future of FinTech in India and beyond. Ready to make a mark?

Table of Contents

The Dynamics of India’s FinTech Ecosystem

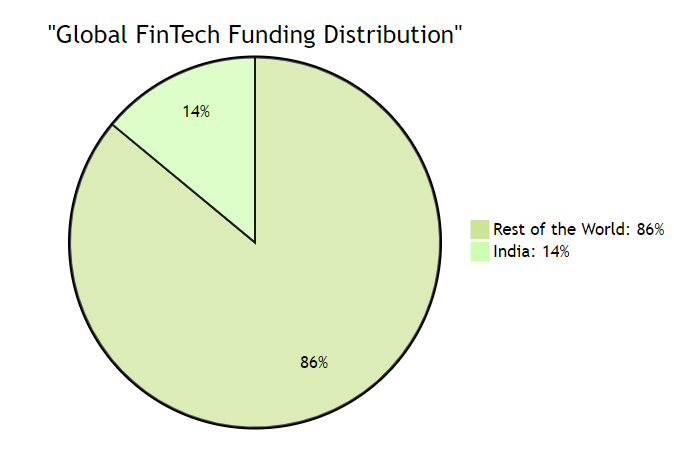

India’s FinTech industry has captured a significant 14% of the global funding pie, positioning it as the second-largest in terms of deal volume. The sector’s potential is immense, with market opportunities projected to reach $2.1 trillion by 2030.

In 2022, FinTech emerged as the second-highest funded startup category in India, securing $5.65 billion in investments. Moreover, the landscape saw a substantial surge in investor interest, with the count of unique institutional investors in Indian FinTech nearly doubling from 535 in 2021 to 1019 in the following year.

At its core, this vibrant landscape is shaped by innovative startups, established traditional banks, and agile non-banking financial companies (NBFCs), each bringing their unique strengths to the table.

- Startups, with their fresh perspectives and technological agility, drive innovation and introduce disruptive financial solutions.

- Traditional banks, leveraging their vast customer bases and deep financial expertise, are increasingly collaborating with tech firms to modernize their offerings.

- NBFCs, on the other hand, fill crucial gaps in financial inclusion, reaching out to underserved segments with tailored financial products.

Amidst this bustling ecosystem, the Indian government’s initiatives, particularly Digital India, play a transformative role. By emphasizing digital infrastructure and services, the government fosters a conducive environment for digital finance and propels the sector’s growth by encouraging the widespread adoption of FinTech solutions.

This environment not only nurtures the development of new technologies and business models but also sets the stage for the next critical aspect of the FinTech revolution: the core technical skills required to navigate and excel in this evolving landscape.

In the next section, we will explore these essential skills that professionals in your organization need to master to contribute effectively to the FinTech narrative. Understanding these skills is crucial for anyone looking to make a mark in this dynamic sector, as they represent the tools and knowledge base necessary to drive the next wave of financial innovation.

5 Essential Technical Skills for FinTech Professionals

As an employer in India’s burgeoning FinTech sector, understanding the pivotal role of tech skills in driving innovation and informed decision-making is crucial for your business. So, let’s check them out:

1. Advanced Data Analysis and Management

The prowess in advanced data analysis and management is not just beneficial but essential for your team. The true value of big data lies in its potential to be transformed into actionable insights, which can revolutionize your approach to financial innovation and strategic decision-making.

The intricacies of data require a sophisticated handling approach, one that transcends basic analysis to interpret complex patterns, consumer behaviors, and emerging market trends.

To thrive, your professionals need to be well-versed in an array of tools and methodologies that are specifically designed to tackle the challenges and leverage the opportunities within the FinTech industry.

This expertise isn’t just about technical know-how; it’s about applying this knowledge to:

- Foresee market shifts

- Customize offerings to meet consumer demands

- Strategically navigate through a competitive and ever-evolving landscape

The mastery of data analytics becomes a critical asset, empowering your team to make informed decisions and innovate with confidence.

Ad: PlayAblo’s Enterprise-Grade Micro-Learning platform is built for millennial learners. Micro-Learning, assessments, and gamification features ensure learning outcome measurement and sustained engagement.

Find out more and request a custom demo!

2. Programming and Development

Your employees need to master preferred programming languages like Python, Java, and R to stand out in the FinTech scene. These languages serve as the building blocks for creating solutions that meet the localized demands of your market.

- Python, with its user-friendly syntax and rich libraries, is indispensable for tasks involving data analytics and machine learning.

- Java, known for its reliability and scalability, is ideal for crafting secure, high-performance financial applications that can handle vast amounts of transactions and data.

- R, with its superior statistical analysis and data visualization capabilities, is crucial for deciphering complex market trends and customer behaviors.

Equipping your team with these skills ensures that your FinTech solutions are innovative and deeply attuned to the specific needs and challenges of your audience. This ability to tailor solutions with precision is what will enable your organization to navigate the FinTech landscape successfully, driving growth and staying ahead of the competitive curve.

3. Blockchain and Distributed Ledger Technologies

Your employees should grasp the nuances of blockchain and distributed ledger technologies, as their adoption is reshaping India’s financial services landscape. This understanding encompasses the technical aspects, the regulatory framework, and practical applications demonstrated through various case studies. Blockchain’s promise of transparency, security, and efficiency has profound implications, from streamlining payment systems to enhancing data integrity in transactions.

Familiarity with real-world applications and regulatory guidelines will empower your team to innovate within legal boundaries while leveraging blockchain’s potential to solve complex financial challenges. This knowledge is crucial for developing blockchain-based solutions that comply with India’s financial regulations and meet the evolving needs of the market.

4. Artificial Intelligence and Machine Learning

Your team needs to delve into the transformative role of Artificial Intelligence (AI) and Machine Learning (ML) within India’s FinTech services. As such, your corporate training modules should cover how AI and ML are revolutionizing areas such as customer service automation, fraud detection, and financial advisory services.

Understanding these technologies’ capabilities allows your employees to harness AI and ML to streamline operations and significantly enhance the customer experience.

- By automating routine tasks, AI can free up your team to focus on more complex issues. Moreover, AI-driven financial advisory services can offer personalized investment advice, making financial planning more accessible to a broader audience.

- ML algorithms can analyze vast datasets to identify fraudulent activities with unprecedented accuracy.

Equipping your team with knowledge in these areas will enable your company to stay at the forefront of innovation in the FinTech sector, driving efficiency and delivering superior value to your customers.

5. Cybersecurity and Regulatory Compliance

Your team must understand the unique cybersecurity challenges faced by the FinTech sector in India, along with the critical importance of adhering to regulations such as the Personal Data Protection Bill. This knowledge is fundamental to safeguarding your operations and customer data against the growing threat landscape.

Familiarity with specific cybersecurity concerns enables your employees to tailor their security strategies effectively, ensuring robust defense mechanisms are in place. Moreover, compliance with regulatory standards is both about maintaining legal adherence and building trust with your customers by demonstrating a commitment to protecting their sensitive information.

Empowering your team with this expertise ensures your FinTech solutions are secure, compliant, and trusted by users, which is essential for sustained growth and success in the competitive financial technology marketplace.

Soft Skills and the Importance of Cultural Fit

While technical skills form the backbone of FinTech innovation, soft skills are the catalysts that enhance and amplify the impact of these technical competencies. In India’s FinTech industry, where diversity and dynamism are at the core, the integration of soft skills with technical expertise is crucial.

Skills such as effective communication, teamwork, and adaptability not only facilitate smoother collaboration within diverse teams but also foster an environment where innovative ideas can thrive.

In a country as culturally rich and diverse as India, understanding and respecting cultural nuances can significantly influence the design and delivery of financial products and services. This cultural fit ensures that solutions are technologically sound and resonate with the target audience’s values and needs.

For instance, effective communication skills enable your team to articulate complex financial concepts in a way that is accessible to a broader audience, breaking down barriers to financial literacy.

Teamwork, in this context, becomes essential in bringing together diverse perspectives and fostering a collaborative environment where different ideas and approaches can be harmonized to create innovative solutions.

Similarly, adaptability is a vital skill in the fast-paced FinTech sector, allowing your team to swiftly respond to market changes, regulatory updates, and emerging customer needs.

In essence, soft skills like these complement and enhance technical abilities, enabling your employees to not only develop cutting-edge FinTech solutions but also ensure these solutions are inclusive, user-friendly, and culturally relevant. This holistic approach to skill integration is what will set your FinTech offerings apart in the competitive landscape, driving both growth and customer satisfaction.

The Role of Corporate Training in Developing a Comprehensive FinTech Skillset

In the dynamic landscape of India’s FinTech sector, developing a comprehensive skillset that encompasses both technical and soft skills is paramount for your firm’s success. Corporate training plays a crucial role in achieving this, offering a structured approach to skill development that caters to the diverse needs of your workforce. Here’s how you can leverage corporate training to build a well-rounded team:

- Partnerships with Educational Institutions: Collaborate with universities and FinTech academies to access specialized courses that combine theoretical knowledge with practical insights. These partnerships can provide your employees with the latest industry trends, technologies, and best practices.

- Internal Training Programs: Design in-house training sessions tailored to your company’s specific needs. These can range from workshops on the latest programming languages and data analysis tools to sessions on enhancing customer interaction and understanding cultural nuances.

- E-Learning and Learning Management Systems (LMS): Implement a robust LMS that offers a range of e-learning courses, enabling employees to learn at their own pace and convenience. Incorporate a mix of microlearning modules for quick skill refreshers, and more in-depth courses for comprehensive learning.

- Mobile Learning: With the increasing use of smartphones, mobile learning allows employees to access training materials anytime, anywhere, fostering a flexible learning environment that fits into their busy schedules.

- Gamification: Introduce gamified elements into your training programs to increase engagement and motivation. Leaderboards, badges, and rewards can make learning more enjoyable and encourage healthy competition among team members.

- Learning Paths: Create personalized learning paths that align with individual career goals and skill gaps. This personalized approach ensures that each employee is equipped with the skills necessary for their specific role and future growth within the company.

- Promoting a Culture of Continuous Learning: Encourage a workplace environment that values ongoing education and self-improvement. Recognize and reward employees who take the initiative to upgrade their skills, and provide regular feedback to support their development journey.

By implementing these strategies, your firm can not only enhance the technical and soft skills of your workforce but also foster a culture of continuous learning and innovation. This holistic approach to corporate training will ensure your team is well-equipped to navigate the challenges and opportunities of the FinTech industry, driving your company’s growth and success in the competitive market.

Ad: PlayAblo’s Enterprise-Grade Micro-Learning platform is built for millennial learners. Micro-Learning, assessments, and gamification features ensure learning outcome measurement and sustained engagement.

Find out more and request a custom demo!

Technological Innovations for FinTech Skill Enhancement

In the ever-evolving FinTech landscape, staying ahead requires more than just traditional training methods. Embracing technological innovations in training and development can significantly enhance the learning experience, making it more effective and engaging.

This section will explore various cutting-edge technologies and methodologies that FinTech companies can adopt to elevate their skill enhancement programs:

- Virtual and Augmented Reality (VR/AR): Utilize VR and AR to simulate real-world financial scenarios, providing immersive learning experiences that can be particularly effective for hands-on training in complex financial services, risk management, and customer service protocols.

- Artificial Intelligence and Personalized Learning: Implement AI-driven platforms that assess individual learning patterns and adapt the curriculum accordingly, offering personalized learning experiences that cater to the unique strengths and weaknesses of each employee.

- Blockchain for Credentialing: Leverage blockchain technology to issue verifiable digital credentials for completed training modules. This not only motivates employees by providing tangible recognition of their achievements but also enhances the transparency and credibility of your training programs.

- Big Data Analytics for Training Optimization: Use big data analytics to evaluate the effectiveness of training programs, identifying which methods are most beneficial and where improvements can be made. This data-driven approach ensures that training resources are allocated efficiently, maximizing ROI.

- Collaborative Learning Platforms: Foster a collaborative learning environment using online platforms where employees can share knowledge, discuss challenges, and work together on projects. This encourages peer learning and harnesses the collective expertise of your team.

- Continuous Feedback Mechanisms: Integrate continuous feedback tools within your training programs to provide real-time insights to learners and instructors. This immediate feedback loop can significantly enhance the learning process, allowing for quick adjustments and improvements.

- Innovation Labs and Hackathons: Establish innovation labs or organize hackathons that challenge employees to develop solutions for real-world FinTech problems. This not only hones their technical skills but also encourages creative thinking and problem-solving.

By integrating these technological innovations into your FinTech skill enhancement strategy, you can provide a more dynamic, effective, and engaging learning experience for your employees. This not only aids in the development of a highly skilled workforce but also fosters a culture of continuous innovation and learning within your organization.

Wrapping It Up

Building a comprehensive skillset in the FinTech sector requires a multifaceted approach that combines technical proficiency with soft skills, and is further enriched by continuous learning and technological innovation.

By embracing these strategies, from corporate training to cutting-edge tech in skill enhancement, your firm can cultivate a workforce that’s not only adept at navigating the complexities of the FinTech landscape but also poised to drive innovation and growth. The future of FinTech is bright, and with a skilled, adaptable, and forward-thinking team, your organization can lead the charge in shaping this dynamic industry.

Ad: PlayAblo’s Enterprise-Grade Micro-Learning platform is built for millennial learners. Micro-Learning, assessments, and gamification features ensure learning outcome measurement and sustained engagement.

Find out more and request a custom demo!